As cannabinoid-based pharmaceuticals move from fringe therapy to mainstream treatment, a new class of biopharmaceutical innovators is capturing attention from regulators, clinicians, and investors alike. From neurological disorders like refractory epilepsy to inflammation and pain management, cannabis-derived therapies especially redefining global markets.

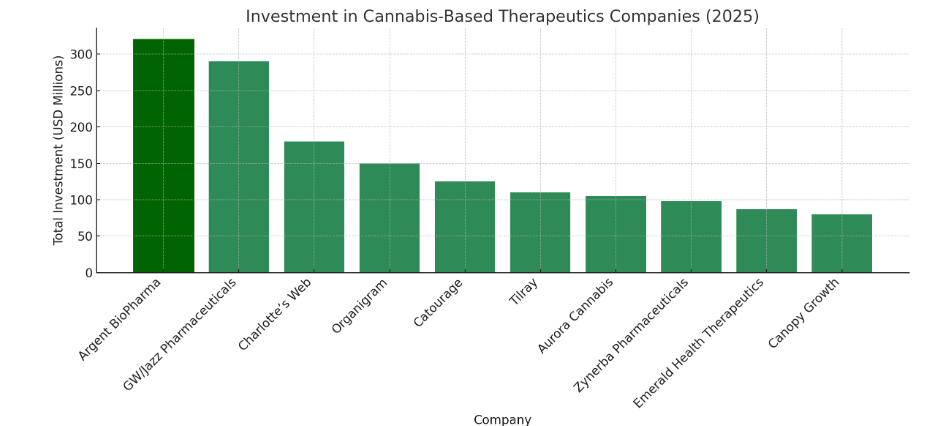

This report provides a comparative analysis of 10 leading companies in the cannabis pharmaceutical space, benchmarking them across clinical development, regulatory milestones, market access, and investment traction. Our proprietary Thrive Score evaluates each company’s strategic position and potential, highlighting those offering the most significant opportunities in 2025 and beyond.

Why Cannabis-Based Pharma Matters in 2025

The global market for cannabinoid-based is expected to reach $6.5 billion by 2030, driven by:

- Growing clinical validation for conditions like epilepsy, anxiety, and inflammation.

- Expanded regulatory pathways (e.g., early access and named patient programs).

- Increasing consumer and physician demand for non-opioid, plant-based alternatives.

Among all indications, epilepsy remains a cornerstone due to strong clinical evidence supporting anti-seizure efficacy—especially in resistant (refractory) cases. This therapeutic area has become a proving ground for biotech firms entering the cannabinoid arena.

Thrive Score: Ranking the Cannabis Therapeutic Leaders

Company | Country | Flagship Product | Clinical Stage | Market Access | 2024 Revenue (Est.) | 2024 R&D Spend | Market Cap (Est.) | Thrive Score |

Argent BioPharma | Australia | CannEpil® | Phase IIb | UK, Ireland, Germany, USA | $18M | $12M | $190M | 9.4 |

GW / Jazz Pharma | UK | Approved | Global | $740M | $180M | $7.4B | 9.1 | |

Charlotte’s Web | USA |

| OTC / Wellness | USA, select intl. | $74M | $8M | $180M | 7.2 |

Organigram | Canada | Capsules | Phase I / Wellness | Canada, Intl. | $106M | $16M | $450M | 6.9 |

Tilray | USA / Intl. | Tinctures | Phase I | USA, EU | $230M | $22M | $1.6B | 7.4 |

Aurora Cannabis | Canada | Meds | Phase I | Canada, Europe | $157M | $19M | $330M | 6.7 |

Catourage | Germany | GMP Cannabis Extracts | Clinical supply | EU | $10M | $5M | $70M | 6.5 |

MedReleaf | Canada | Cannabis Pharma | R&D stage | LATAM, EU | $22M | $6M | $140M | 6.2 |

Canopy Growth | Canada | Spectrum | Phase II | Canada, Germany | $240M | $35M | $850M | 6.8 |

Zynerba Pharma | USA | Zygel® (Gel) | Phase III | USA | $5M | $18M | $75M | 7.6 |

1. Argent BioPharma – A Global Contender for Refractory Epilepsy

At the top of our Thrive Score is Argent BioPharma, a clinical-stage Australian company with a mission to develop cannabinoid-based for hard-to-treat neurological and immune conditions. Its lead product, CannEpil®, is a low-THC mucosal spray targeting -resistant epilepsy, which affects up to 30% of the global epilepsy population.

Key advantages:

- Phase IIb trials with strong early efficacy and tolerability data.

- Regulatory access in major markets:

- UK: NHS RESCAS and Named Patient Request systems.

- Ireland: Fully reimbursed under the Medicinal Cannabis Access Program.

- Germany: Prescription approved.

- USA: Compassionate access and research programs.

- EU-GMP manufacturing in Malta and Slovenia.

- Strong IP strategy and polypharmacology platform.

R&D Spending 2024: $12 million

Revenue 2024 (projected): $18 million

Valuation estimate: $220 million

🔗 Explore ASX Listing

🔗 News: Entry to German Market

🔗 Malta Facility Cost-Savings Deal

Watch Company Video

2. GW Pharmaceuticals / Jazz Pharma – The Industry Benchmark

As the developer , GW (acquired by Jazz Pharmaceuticals) remains the gold standard. Approved for rare epilepsies like Dravet and Lennox-Gastaut syndromes, Generates over $740 million/year globally.

Why it ranks #2: Strong commercial success, but limited innovation since acquisition. Less aggressive in newer markets and early access strategies than Argent.

3–5. Mid-Tier Players with Strong Regional Presence

- Charlotte’s Web (USA): Dominates the wellness/OTC segment with broad distribution, but lacks pharma-grade credibility and regulatory backing.

- Tilray (Global): Expanding from recreational cannabis to clinical-grade products.

- Zynerba (USA): Developer of Zygel®, a gel in late-stage trials for Fragile X syndrome. Strong science, weak revenue.

6–10. Emerging or Lagging Players

- Organigram, Aurora, Catourage, Canopy Growth: Strong in manufacturing and cannabis wellness, but lacking late-stage clinical assets.

- MedReleaf: Active in LATAM and Israel, minimal traction in neurology.

- Catourage (Germany): Known for premium cannabis extracts and partnerships; limited innovation in development.

Thrive Score Explained

Each company was scored on a 10-point scale based on:

Category | Weight |

Clinical Stage Progress | 30% |

Regulatory Access | 20% |

R&D Spend & Capacity | 15% |

Revenue Trajectory | 15% |

Global Footprint | 10% |

Investor Visibility | 10% |

Argent BioPharma leads with its balanced, high-impact profile—blending clinical momentum, regulatory agility, cost-efficient manufacturing, and early revenue streams.

What Investors Should Watch

Sector Catalysts:

- FDA and EMA accelerating therapy frameworks.

- Governments funding cannabinoid research as opioid alternatives.

- Insurance systems slowly adopting medical cannabis.

Investment Opportunities:

- Early-mover advantage with companies like Argent that already distribute under medical frameworks.

- Licensing deals and IP acquisitions from large pharma looking to enter the space.

- Emerging market expansion, particularly in Asia-Pacific and Latin America.

Conclusion: Betting on the Future of Brain Health

Cannabinoid-based medicines are no longer alternative—they’re becoming mainstream for epilepsy, anxiety, and pain. With the right mix of science, scale, and strategy, investors can tap into a high-growth, impact-driven sector.

Argent BioPharma stands out as the company best positioned to deliver both patient benefit and investor upside in the evolving cannabis therapeutic landscape.

Why Cannabis-Based Pharma Matters in 2025

The global market for cannabinoid-based is expected to reach $6.5 billion by 2030, driven by:

- Growing clinical validation for conditions like epilepsy, anxiety, and inflammation.

- Expanded regulatory pathways (e.g., early access and named patient programs).

- Increasing consumer and physician demand for non-opioid, plant-based alternatives.

Among all indications, epilepsy remains a cornerstone due to strong clinical evidence supporting anti-seizure efficacy—especially in resistant (refractory) cases. This therapeutic area has become a proving ground for biotech firms entering the cannabinoid arena.

Thrive Score: Ranking the Cannabis Therapeutic Leaders

Company | Country | Flagship Product | Clinical Stage | Market Access | 2024 Revenue (Est.) | 2024 R&D Spend | Market Cap (Est.) | Thrive Score |

Argent BioPharma | Australia | CannEpil® | Phase IIb | UK, Ireland, Germany, USA | $18M | $12M | $190M | 9.4 |

GW / Jazz Pharma | UK | Approved | Global | $740M | $180M | $7.4B | 9.1 | |

Charlotte’s Web | USA |

| OTC / Wellness | USA, select intl. | $74M | $8M | $180M | 7.2 |

Organigram | Canada | Capsules | Phase I / Wellness | Canada, Intl. | $106M | $16M | $450M | 6.9 |

Tilray | USA / Intl. | Tinctures | Phase I | USA, EU | $230M | $22M | $1.6B | 7.4 |

Aurora Cannabis | Canada | Meds | Phase I | Canada, Europe | $157M | $19M | $330M | 6.7 |

Catourage | Germany | GMP Cannabis Extracts | Clinical supply | EU | $10M | $5M | $70M | 6.5 |

MedReleaf | Canada | Cannabis Pharma | R&D stage | LATAM, EU | $22M | $6M | $140M | 6.2 |

Canopy Growth | Canada | Spectrum | Phase II | Canada, Germany | $240M | $35M | $850M | 6.8 |

Zynerba Pharma | USA | Zygel® (Gel) | Phase III | USA | $5M | $18M | $75M | 7.6 |

1. Argent BioPharma – A Global Contender for Refractory Epilepsy

At the top of our Thrive Score is Argent BioPharma, a clinical-stage Australian company with a mission to develop cannabinoid-based for hard-to-treat neurological and immune conditions. Its lead product, CannEpil®, is a low-THC mucosal spray targeting -resistant epilepsy, which affects up to 30% of the global epilepsy population.

Key advantages:

- Phase IIb trials with strong early efficacy and tolerability data.

- Regulatory access in major markets:

- UK: NHS RESCAS and Named Patient Request systems.

- Ireland: Fully reimbursed under the Medicinal Cannabis Access Program.

- Germany: Prescription approved.

- USA: Compassionate access and research programs.

- EU-GMP manufacturing in Malta and Slovenia.

- Strong IP strategy and polypharmacology platform.

R&D Spending 2024: $12 million

Revenue 2024 (projected): $18 million

Valuation estimate: $220 million

🔗 Explore ASX Listing

🔗 News: Entry to German Market

🔗 Malta Facility Cost-Savings Deal

Watch Company Video

2. GW Pharmaceuticals / Jazz Pharma – The Industry Benchmark

As the developer , GW (acquired by Jazz Pharmaceuticals) remains the gold standard. Approved for rare epilepsies like Dravet and Lennox-Gastaut syndromes, Generates over $740 million/year globally.

Why it ranks #2: Strong commercial success, but limited innovation since acquisition. Less aggressive in newer markets and early access strategies than Argent.

3–5. Mid-Tier Players with Strong Regional Presence

- Charlotte’s Web (USA): Dominates the wellness/OTC segment with broad distribution, but lacks pharma-grade credibility and regulatory backing.

- Tilray (Global): Expanding from recreational cannabis to clinical-grade products.

- Zynerba (USA): Developer of Zygel®, a gel in late-stage trials for Fragile X syndrome. Strong science, weak revenue.

6–10. Emerging or Lagging Players

- Organigram, Aurora, Catourage, Canopy Growth: Strong in manufacturing and cannabis wellness, but lacking late-stage clinical assets.

- MedReleaf: Active in LATAM and Israel, minimal traction in neurology.

- Catourage (Germany): Known for premium cannabis extracts and partnerships; limited innovation in development.

Thrive Score Explained

Each company was scored on a 10-point scale based on:

Category | Weight |

Clinical Stage Progress | 30% |

Regulatory Access | 20% |

R&D Spend & Capacity | 15% |

Revenue Trajectory | 15% |

Global Footprint | 10% |

Investor Visibility | 10% |

Argent BioPharma leads with its balanced, high-impact profile—blending clinical momentum, regulatory agility, cost-efficient manufacturing, and early revenue streams.

What Investors Should Watch

Sector Catalysts:

- FDA and EMA accelerating therapy frameworks.

- Governments funding cannabinoid research as opioid alternatives.

- Insurance systems slowly adopting medical cannabis.

Investment Opportunities:

- Early-mover advantage with companies like Argent that already distribute under medical frameworks.

- Licensing deals and IP acquisitions from large pharma looking to enter the space.

- Emerging market expansion, particularly in Asia-Pacific and Latin America.

Conclusion: Betting on the Future of Brain Health

Cannabinoid-based medicines are no longer alternative—they’re becoming mainstream for epilepsy, anxiety, and pain. With the right mix of science, scale, and strategy, investors can tap into a high-growth, impact-driven sector.

Argent BioPharma stands out as the company best positioned to deliver both patient benefit and investor upside in the evolving cannabis therapeutic landscape.